Six Steps for Process Mining Project Success (Pt. 1) — Overview and Strategy

Process Mining is more than a technology or a single process analysis approach. It is an assembly of analysis methods that have been done in the past, but are now based on data (in the form of an event log from runtime systems) and supported by a tool that does the process-oriented calculations for you.

However, it is not as simple as to throw a big data export file on the software and the tool will “auto-magically” figure out your process problems. Nor is it a one-step project approach, as some vendors might want to make you believe.

Based on dozens of successful Process Mining implementations, a six-step approach to Process Mining projects has crystallized that will be discussed here. This approach will make sure that you get the right process selected and use the necessary data for your analysis so that you can identify the appropriate improvement opportunities that make an impact in your organization.

Over the course of four articles, we will walk you through the six steps of a successful Process Mining project. This article will give you an overview of the process, who is involved, and a deep dive into the first step “Define [the Process Mining] strategy”.

The six steps in an overview

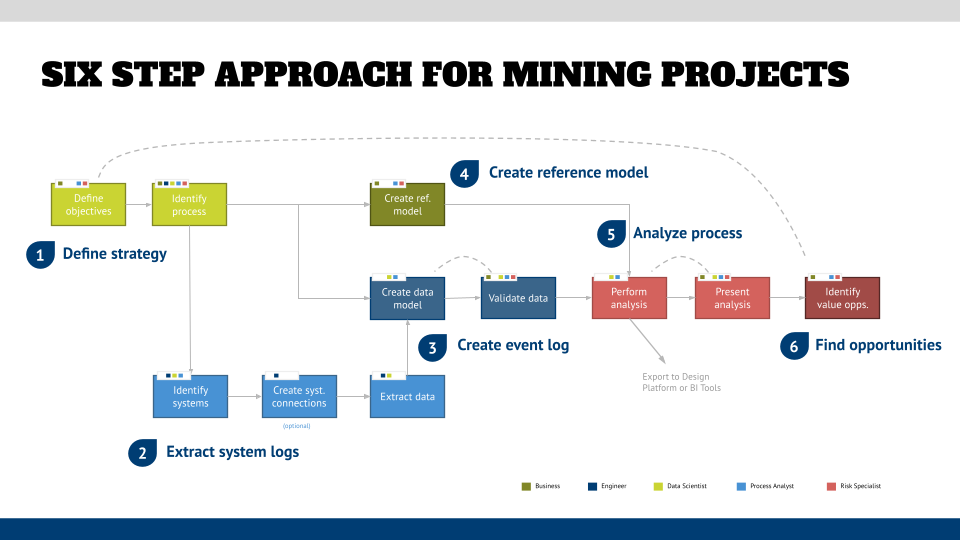

“Each journey begins with the first step” is what they say and that is also true for your first steps in implementing a Process Mining capability in your organization (and we are looking here at Process Mining and not Task Mining or other data-driven analyses, which might follow a similar approach, but will change slightly based on the used technology). The following graphic shows the six steps in an overview:

The six steps are:

- Define the Process Mining strategy – what do you want to accomplish with this new capability in your organization, how will it be implemented, and what are the first projects and desired outcomes?

- Extract system logs – identify the source systems for each step in the process, create technical interfaces for automated data feeds into the Process Mining tool (optional), and extract the events logs from the tables in the source systems.

- Create event log – this step includes the data cleansing and data transformation, so that at the end of it an event log that includes information from all source tables can be loaded into the Process Mining tool.

- Create reference process: one feature of Process Mining tools is the ability to compare a reference diagram in BPMN format (“How work should be done”) with the reality of the event log data (“How work was done”). In this step, the how-work-should-be-done process model will be defined/refined.

- Analyze process is the application of the various analysis types in Process Mining tool. But it does not stop with showing the “what” (the discovered process with its statistics) but also the identification of the “why” (and where, who, and how) of performance problems.

- Find improvement opportunities, based on the analysis. However, this also includes the creation of a (high-level) business case for each potential opportunity, so that stakeholders can decide.

Who is involved in this approach?

Process Mining is not something that a data or process analyst does in a dark backroom and then suddenly shows up with the once-in-a-lifetime breakthrough idea. It is -as always in business- a team play, and you have to set up a multidisciplinary team to be successful.

- Business representatives: the people who are actually performing the process and/or are responsible for them (aka Subject-Matter Experts / SMEs). These are the resources you need who know the current process with all of its applications, data, “unwritten rules”, and performance issues.

- (Process Mining) Engineers – these are the technical people who own the source systems, and also the engineers who will build integrations to those systems to enable automated / scheduled feeds into the Process Mining tool.

- Data scientists. Process Mining has the new(-ish) quality of being based on the data that comes from the source systems, and requires people who can take raw data and transform it into the tabular format that your Process Mining tool requires.

- Process analysts are the traditional resources who analyze the process using the different features and techniques in the Process Mining tool, but also bring in a Lean/6Sigma background to find the different form of wastes and also bring the statistical knowledge to decide if what you see in the tool is relevant or “just an outlier”.

- Risk specialists – one big topic in Process Mining is “compliance” (aka do my users do what they are supposed to do), and these are the resources who are experts in this. They also bring the knowledge of risks in the process and the frameworks behind them, and can add another perspective to the development of hypothesis.

Step 1: Define strategy

One of the first things when implementing Process Mining for the first time is to take a step back and think about what you want to accomplish with this technology and approach. But there is more because you need to choose the right process for your first steps so that you can build momentum and excitement in your organization.

I recommend going through the following steps and capturing your decisions for future reference and adjustment.

- Determine process mining objectives for your organization. This should be obvious, but I have seen numerous clients just “trying out” the tools and get frustrated because they don’t give you obvious answers, and you will have to do the actual analysis work.

What you want is to define and assemble the list of objectives and then align them to your businesses’ strategy and also the running projects and the organization’s appetite for “another new software”. Even though you might be excited about the new technology, you might find that other parts of the organization have “transformation exhaustion” and just cannot take in something new. In this case, try to find areas in your organization that are more receptive to this and scale down your ambition. It is better to have something deployed and make some users into believers, than pushing too hard on more valuable targets who will become anything but advocates. - Which leads us to the next step – you need to develop a short- and long-term plan for this capability. Besides the fact that Process Mining can be an expensive exercise (not only regarding the license costs, but mostly because of the effort and number of people involved) and you might want to make sure that you deploy it to your most important processes – the ones where you get a strategic advantage for.

Interesting enough, the majority of examples that I have seen are commodity processes, such as Procure-to-Pay or Order-to-Cash. My advice here is to have a nuanced approach to this – if a process is a commodity, you might want to standardize and automate it as much as possible. Process Mining might be a monitoring exercise here, and if the numbers you see are “good enough”, then you might want to focus on something else. If the process is a unique process that gives your organization an advantage, then you might want to tweak your analysis to a much deeper level after the first implementation and analysis.

Either way, you need to come up with a plan that balances the benefits for the organization with the cost and the opportunity to build momentum. You need to decide if you want to have that one big project or a series of smaller projects that will grow your user base and their acceptance. - Determine “what good looks like” for processes in your organization. This is a crucial step, and we will refer to this a couple of times below.

There are a limited number of levers that a process can have and that you can influence – for example, the capacity of a process: how many widgets can I produce in a given time (or for white-collar scenarios: how many loan applications can be underwritten)? A second one is the course of time: how long does the process or a step within the process take? Where are the bottlenecks? Or other factors like customer experience, cost, compliance, caliber (quality), and so on.

You need to define for your organization what the mix of all of these levers are. If your focus is on speed-to-market, then you will hire more resources or buy machines and software more easily, as if your main focus is cost or if the regulators are watching over your shoulder. You might want to document these levers and socialize them in your organization so that you get the buy off from the decision makers, but also the acceptance of the business unit members that will execute the process that you want to analyze. - Identify the right process for your first project: This relates closely to the previous topics. You would like to select a process that has a business impact when you find improvement opportunities (aka no technology evaluation but true benefits). But you also don’t want to tackle that big hairy beast as your first project because you will learn a lot about the process of doing Process Mining projects. These six steps here are a good start. You also want to have a quick turnaround of results in a few weeks. Your stakeholders will lose excitement if you take months to present them results that they then might find underwhelming – not a good start to build momentum.

- Create a “napkin-level” process diagram of the three processes that you have identified. It would be great if you already have a mature BPMN diagram of the process in scope, but at this point in the game you don’t need that.

What you want to have is a level of fidelity that allows you to identify the steps of the process, its logic, and maybe some exceptions that will help you in identifying the systems of record for each step.

This will also help you determine who you need to involve from a business SME perspective and check the feasibility of a potential timeline – if you cannot get a SME for your process, then you should choose a different process.

In Step 4 you will then take this rough process and create a more detailed version of it in BPMN format that depicts how work should be done in more detail.

- Define hypotheses for performance issues: One misconception of Process Mining (and occasionally this will be communicated by the tool vendors) is that you just have to connect the data to the tool.

It is true that you can get some good analysis results from mandatory information in the data set and the upload of a reference process. But the more in-depth insights come from performing a detailed analysis that is aligned to hypotheses. What is always going wrong in your process execution? What are the reasons for this? What could be resolutions for solving these problems?

What you want is to have a list of hypotheses and assumptions that lead your data collection (Step 2) and process analysis (Step 5). You want to have the needle in the haystack defined, instead of just pointing to one (or more) haystacks without instructions of what to find in them.

Remember: you can always extend your analysis and if your initial hypothesis-based analysis does not bring the “breakthrough results”. You can always extend them and extend your analysis in a future iteration. - Socialize the results with your stakeholders: As mentioned above already, you might want to socialize your definitions and results with your stakeholders. Keep in mind that you have different stakeholder groups for different topics – your decision-makers will approve budgets, but everyone will be interested in things like the “what good looks like” definitions. On the other hand, you might have much smaller stakeholder groups when it comes to the individual processes that you have selected on a working level. But you definitely want to have their leadership included in the main aspects of the processes (“informed” or “accountable” RACI relationship).

What you aim to create is a stakeholder map, which is a topic for a different article, and engage the Organizational Change Management professionals who have this method in their standard toolbox. They most likely also have experience with the individuals in your organization and know what their preferred communication style is.

You also want to plan communication activities and align them to your stakeholder groups in the program – “this is relevant for all stakeholders, but this is only relevant for this subgroup”. The main takeaway is that you always want to have your stakeholders engaged and show progress that is meaningful for them.

What’s Next?

In the next article of this series, we will continue the walkthrough of the six steps and take a closer look at the steps of extracting system logs and creating the data model for your Process Mining project.

Roland Woldt is a well-rounded executive with 25+ years of Business Transformation consulting and software development/system implementation experience, in addition to leadership positions within the German Armed Forces (11 years).

He has worked as Team Lead, Engagement/Program Manager, and Enterprise/Solution Architect for many projects. Within these projects, he was responsible for the full project life cycle, from shaping a solution and selling it, to setting up a methodological approach through design, implementation, and testing, up to the rollout of solutions.

In addition to this, Roland has managed consulting offerings during their lifecycle from the definition, delivery to update, and had revenue responsibility for them.

Roland has had many roles: VP of Global Consulting at iGrafx, Head of Software AG’s Global Process Mining CoE, Director in KPMG’s Advisory (running the EA offering for the US firm), and other leadership positions at Software AG/IDS Scheer and Accenture. Before that, he served as an active-duty and reserve officer in the German Armed Forces.

2 Responses

Comments are closed.